What are Financial Statements?

KEY POINTS

The 4 primary financial statements are the balance sheet, statement of retained earnings, income statement, and statement of cash flows

Each set of users of the financial statements has their own distinct informational needs

You can use basic financial statement theory to create your own net worth statement

What are financial statements?

Every company, partnership, foundation, and trust create financial statements. They can be generated monthly, quarterly, semi-annually, and annually. They provide insights into the entity’s financial health and are utilized by a variety of groups with different needs.

Management interpret financial statements when measuring performance and making decisions related to capital requirements, debt and equity financing, expansion, allocation of resources, and more.

Investors and creditors will use financial statements with different assurance levels associated with them (e.g., audit, review, compilation) as a key component of their investing and lending decisions.

Four Primary Financial Statements

Balance Sheet

The balance sheet reports the assets owned, liabilities owed, and the equity of the entity as at a specific date. The assets and liabilities can be split between current and long-term. Current assets can be converted into cash within one year and current liabilities are due within one year. All other assets and liabilities are classified as long-term.

Key Concept

The following equation is key to understanding financial statements.

Assets = Liabilities + Shareholders’ Equity

It shows the respective claims the entity’s creditors and shareholders have over the assets.

We can restate the equation as,

Assets – Liabilities = Shareholders’ Equity

It may be easier to understand if we take a personal perspective. If you wanted to calculate your own net worth, you would value all your assets and liabilities at market value and input them into the following equation:

Assets – Liabilities = Net Worth

It is the same equation. A key difference is that your net worth is based on current market values, whereas entity financial statements are typically based on historical cost.

The following is an example of a balance sheet,

Assets

Assets represent property owned by the entity that have a future economic benefit. Such may include,

Liabilities

Liabilities represent amounts owed by the entity. Such may include,

Shareholders’ Equity

Shareholders’ equity represents an entity’s share capital plus retained earnings. Such may include,

Statement of Retained Earning

The statement of retained earnings shows the entity’s cumulative and current earnings. The following is an example of a Statement of Retained Earnings,

Income Statement

The income statement shows the entity’s financial results for a given period (e.g., monthly, quarterly, semi-annual, annual). The following is an example of an income statement,

Revenue

Revenue measures the gross income earned by an entity. Such may include,

Cost of revenue

Cost of revenue is the total cost related to the manufacturing and delivery of the entity’s products and services. Such may include,

Expenses

Expenses are usually the result of a cash outflow or the reduction of an asset. Such may include,

Statement of Cash Flows

The statement of cash flows shows the entity’s cash flows during the period related to operating, investing, and financing activities. The following is an example of a statement of cash flows,

How are the financial statements connected?

First, let’s start with the basics with respect to how each group of accounts is set-up. Each group of accounts consist of accounts that have debit balances or credit balances. Therefore, each transaction consists of. accounts that are either debited or credited.

Debit refers to the left-hand side of the ledger.

Credit refers to the right-hand side of the ledger.

Asset accounts have a debit balance. At this point we should revisit our foundational equation,

Assets = Liabilities + Shareholders’ Equity

If assets have debit balances, then liabilities and shareholders’ equity accounts must have credit balances for the above equation to balance.

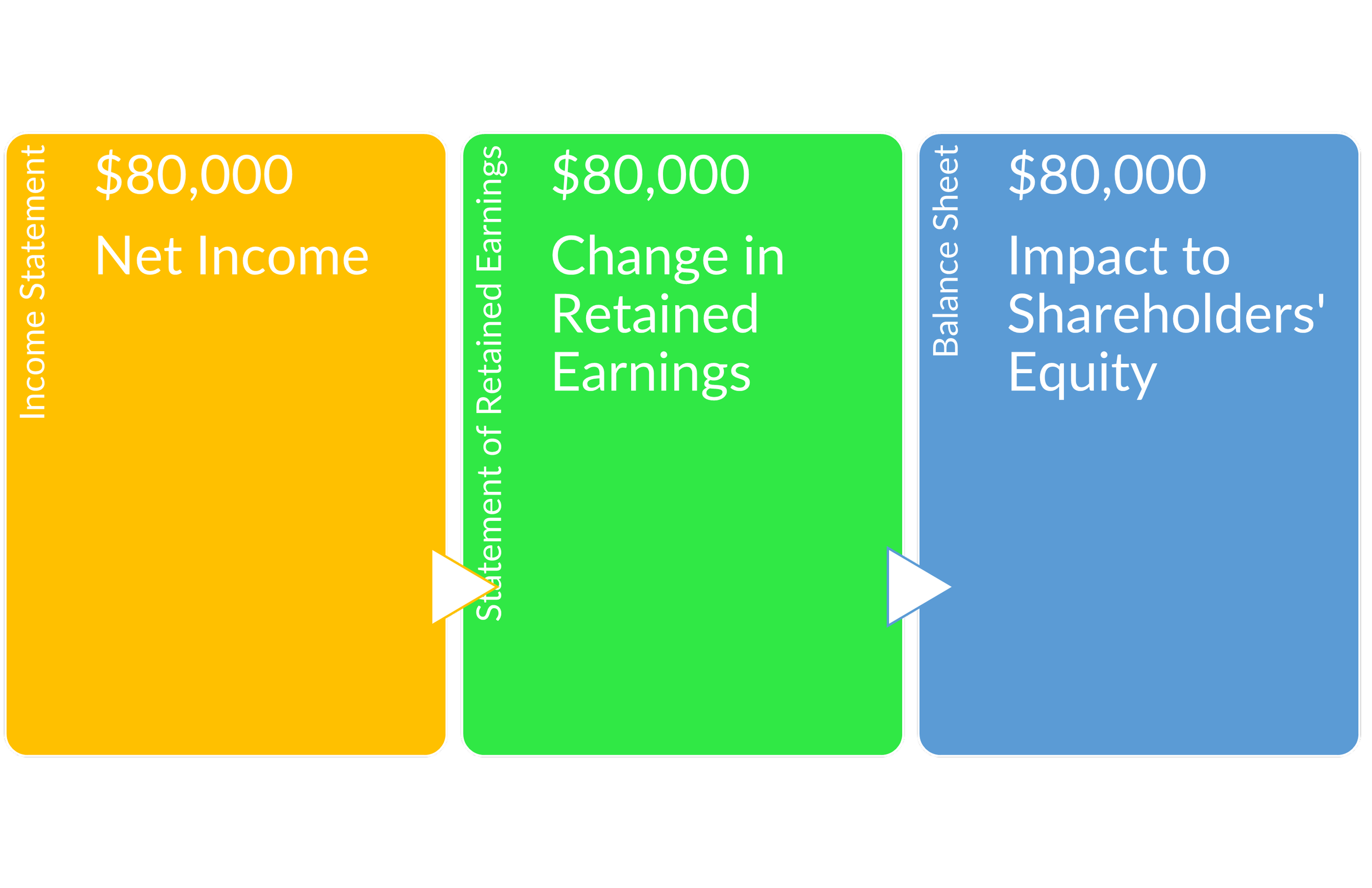

As illustrated in the financial statements above, net income increases shareholders’ equity. Therefore, net income would implicitly be a net credit impact (a net loss would be a net debit). Therefore, revenue accounts have credit balances and expense accounts have debit balances.

That is a lot of technical detail to absorb. A visual illustration may clarify the mechanics and related information flow. The following illustration has three transactions,

Sell $100 services for cash

Purchase $50 office supplies on account

Depreciate $20 of fixed assets

The methodology of this chart is illustrated in the financial statements highlighted above. For example, the 2022 financial statements tie together as follows:

Visualize How Financial Statements Connect

Now that we covered the basics with respect to debits and credits, we can revisit our sample financial statements and visualize how they link together as illustrated below (follow the arrows).

Bottom Line

This post introduces the nature of financial statements. We will provide future posts regarding how to interpret financial statements and what role an accounting firm plays in providing assurance over a set of financial statements.