RRSP vs. TFSA: Which Strategy is Best for You?

KEY POINTS

Many people think TFSAs are only superior to RRSPs for incomes under $50,000. Our models show they are competitive for incomes up to approximately $100,000 (potentially even higher), depending on a taxpayer’s other sources of income, time horizon, and marital status.

We highlight several tips and warnings for navigating the complex world of RRSPs and TFSAs

The investing side is only one aspect of RRSPs and TFSAs. You should consider the ability to leverage, flexibility, and alignment with your specific investment goals.

Virtually every adult I know has asked me:

RRSP or TFSA?

It is a tough question to answer as everyone has a unique profile and the ultimate decision will be based on more than just the numbers.

We will illustrate a model for a single individual. The concepts will be applicable to all whether you are single, married, have dependents, or not.

We will also highlight some of the variables that will impact your decision-making process including, but not limited to income level and growth rate, marginal tax rates, rate of return, contribution limits, accessibility, borrowing capabilities, and more.

Let’s review the key attributes of an RRSP and a TFSA before we run the numbers.

Registered Retirement Savings Plan (“RRSP”)

An RRSP is a tax deferred savings vehicle that was first introduced in 1957 and can help you save, borrow, and defer taxes. It allows taxpayers to contribute to a designated account subject to prescribed annual maximum contribution limits. Such contributions are tax deductible by the individual and can reduce the individual’s taxes payable based upon their marginal tax rate.

RRSP Contributions

Contributions are limited to the lesser of 18% of an individual’s prior year earned income as reported on their tax return and the prescribed contribution limit. The prescribed contribution limit changes every year and is $30,780 for 2023. CRA will impose significant penalties if contributions exceed the limit (there is a $2,000 grace threshold before such penalties are applied).

Contributions can be carried forward to a future year if not deducted in the year the contribution is made. Such may be beneficial if your subsequent year income will be in a higher tax bracket. Similarly, unused contribution room can be carried forward to a future year and such balance is cumulative.

Warning

Your contribution room is permanently reduced upon contributing to your RRSP. Therefore, unlike a TFSA (see below), a subsequent withdrawal from your RRSP will not increase your contribution room.

Tip

Reduce the tax deducted by your employer by filing form T1213 Request to Reduce Tax Deductions at Source with the Canada Revenue Agency (“CRA”). This form needs to be submitted to CRA annually.

Contributions can be invested in a variety of assets including cash, fixed income, equities, exchange traded funds, mutual funds, income trusts, options, and more. The growth on such assets is not taxable while it remains in the RRSP; hence, the tax deferral nature of the investment vehicle. Such growth may consist of capital gains, dividends, interest, foreign exchange, etc.

Tip

Allocate securities subject to higher tax rates to your RRSP and lower taxed assets to your non-registered account, assuming you hold assets in both types of accounts. For example, you may consider allocating bonds to your RRSP and equities to your non-registered account as interest is taxed at a higher rate than dividends.

Tip

The higher income spouse can make contributions to a spousal RRSP. The higher income spouse that made the contribution will receive the taxable benefit from such contribution. The assets in the spousal RRSP become legal property of the spouse and are included in the spouse’s income upon withdrawal.

RRSP Withdrawals

Withdrawals from an RRSP can be made at any age and are taxable in the year of withdrawal. The full amount of the withdrawal is included in the individual’s taxable income and taxed at the individual’s respective marginal tax rate. The financial institution holding your RRSP will withhold taxes on all withdrawals: like how your employer withholds taxes on your pay stub.

Tip

Your marginal tax rate will likely decrease when you retire. Therefore, your current contributions may generate a higher marginal tax benefit than the future marginal tax cost of your withdrawals.

You cannot keep your investments tax sheltered in an RRSP indefinitely.

At age 71, your RRSP will automatically convert to a Registered Retirement Income Fund (“RRIF”). The assets remain tax deferred while in the RRIF; however, you can no longer make contributions and there is a prescribed formula for mandatory annual withdrawals. Such withdrawals will be included in your income in the year of withdrawal and taxed at your marginal tax rate.

Withdrawals may increase your taxable income to a level that triggers a claw back of your Old Age Security and Guaranteed Income Supplement. Such may provide tax planning opportunities with respect to the timing of when and how much of your RRSP you withdraw.

Upon death of the RRSP account holder the assets are transferred directly to the beneficiary named on the account as the RRSP does not form part of the estate for probate purposes. The RRSP can continue and maintain its tax-deferred status if the beneficiary is a spouse or common-law partner. Such tax deferred transfer can also be made to dependent children and grandchildren under 18 years of age, or a financially dependent mentally or physically infirm child or grandchildren at any age.

Warning

The full amount of your RRSP will be taxed based on your highest marginal tax rate in the year of your death, unless you have named your spouse, common-law partner, or specific dependents as a beneficiary of the RRSP. This may create taxation at the highest tax rate possible whereas the original contributions may have been made at substantially lower tax rates.

Tip

Consider reducing your annual RRSP contributions, or even implementing a systematic withdrawal plan, if you have not named any beneficiaries that will qualify for a tax deferred transfer upon death. Such may produce a lower tax impact than if your estate were to be taxed at the highest rate upon your death. You will have to perform a financial sensitivity analysis to see if this option is worth taking the risk as there is no definitive correct action to take.

The Canadian government has created two programs linked to the RRSP aimed at helping taxpayers purchase their first home and obtain a post-secondary education.

RRSP - Home Buyers’ Plan (“HBP”)

First time home buyers are eligible to borrow up to $35,000 from their respective RRSPs to purchase or build a qualifying home for themselves or for a related person with a disability. You and your spouse or common-law partner can both withdraw $35,000 each from your respective RRSPs, if you both qualify as first-time home buyers. Your RRSP issuer will not withhold taxes on the amount withdrawn with respect to the HBP.

Tip

You may be able to participate in the HBP more than once if your repayable HBP balance on January 1 of the year of withdrawal is zero. There are several other specific conditions that must be met. A key one to consider is that you must not have lived in a home that you or spouse or common-law partner owned during the previous 4 years. Therefore, you must have sold your prior home and lived in a rental for such 4-year period.

You must intend to occupy the qualifying home as your principal residence within one year after buying or building it. If the home is purchased or built for a related person with a disability, such person must intend on occupying the home within the same timeframe.

You have a maximum of 15 years to repay the amount borrowed to your RRSP. The balance can be paid off earlier, at your discretion. Repayment of the HBP to the RRSP is a loan repayment and will not generate a tax deduction. Upon filing your annual tax return, CRA will send you an annual statement summarizing your HBP account.

RRSP - Lifelong Learning Plan (“LLP”)

You can withdraw up to $10,000 per calendar year from your RRSP to fund full-time training or education for you or your spouse or common-law partner. Any amount withdrawn over $10,000 in a given calendar year will be included in your taxable income. The maximum cumulative withdrawal from your RRSP is $20,000.

The amount you withdraw is not limited to the amount of your tuition or other education expenses.

You can make withdrawals every year, provided you continue to meet the LLP requirements, until January of the fourth calendar year after the year you made your first LLP withdrawal.

You cannot make withdrawals to support the educational pursuits of your children or your spouse’s or common-law partner’s children.

Tax Free Savings Account (“TFSA”)

A TFSA is a tax-free savings vehicle that was first introduced in 2009. It allows taxpayers to contribute after-tax dollars to a designated account subject to prescribed annual maximum contribution limits. Unlike RRSPs, contributions to a TFSA are not tax deductible by the individual and do not reduce the individual’s taxes payable.

TFSA – Contributions

The annual TFSA contribution limit for 2023 is $6,500 and will be indexed to inflation annually to the nearest $500. Historical contribution limits are as follows:

Your contribution room will accumulate annually even if you do not file a tax return or open a TFSA account. Contributions more than your contribution limit will result in a penalty or tax. You can make withdrawals at any time, and such allow you to recoup the related contribution room previously utilized. Such adjustment to your contribution room will occur the following calendar year.

Tip

Unlike an RRSP, a spousal TFSA option does not exist. Therefore, if you have reached your contribution limit, it may be advantageous to give your spouse or common-law partner your excess investable funds to invest in their TFSA.

You can invest in a variety of asset classes, like RRSPs, including cash, guaranteed investment certificates, fixed income, equities, mutual funds, exchange traded funds, certain shares of small business corporations, etc. You cannot invest in real property.

Warning

CRA has taken individual taxpayers to court regarding the nature of their TFSA accounts and related trading activity. If such activity is considered to be a business (e.g., day trading) the income generated with the TFSA may be fully taxable.

Tip

It may be advantageous to allocate your high-risk high-growth securities to your TFSA. The potential above average capital gains would be earned tax-free.

As noted, you do not receive a tax deduction for your contributions. However, the growth of assets within the TFSA is generally tax-free. Such tax-free sources of income include dividends, interest, capital gains, foreign exchange, etc.

TFSA Withdrawals

Unlike RRSPs, withdrawals from your TFSA will not trigger claw back provisions related to your Old Age Security or Guaranteed Income Supplement. Such withdrawals will also have no impact on Employment Insurance, Canada Child Benefit, Canada Workers Benefit, GST/HST tax credit, or the age amount.

You can designate beneficiaries of your TFSA. One advantage to this is that the TFSA will be transferred directly to your beneficiaries upon your death without such assets being subject to probate and the related fees and bureaucracy.

Tip

Consider naming your spouse or common-law partner the successor holder of your TFSA instead of the beneficiary. A successor becomes the new owner of the TFSA and the tax-free status continues uninterrupted.

RRSP vs. TFSA

Financial Breakeven Analysis

Finally, we get to the numbers. The above overview was a bit longer than we anticipated. We trust it has prepared you for the following analysis and charts.

There are many websites with interactive financial models that allow you to change some key variables (income, investment growth rate, etc.) and see a bar chart comparison of an RRSP vs. TFSA. These basic calculators have limited usefulness; however, I encourage you to do a web search and check them out.

Our financial model is more complex. Therefore, for this article we have limited it to a single individual taxpayer, no children, investing from age 20 to 65, and withdrawing from their RRSP or TFSA from age 65 to 80.

The concepts discussed are applicable to all taxpayers; however, the breakeven point may change dramatically. The number of years contributing and the potential for other sources of income can have a substantial impact on the model.

RRSP vs. TFSA – Financial Model

Our model assumes the following,

Annual contributions of $5,000 after-tax equivalent dollars to an RRSP and TFSA

Contribution period is from age 25 to 65

Taxable income levels modelled are in $10,000 increments from $40,000 to $250,000

Annual compounded growth rate of 6%

Life expectancy is 80 years of age

At age 65, the value in each account is treated like an annuity and redeemed in equal amounts from age 65 to 80, at which time the balance in each account will be nil

Current marginal tax rates are based on an Ontario resident and are held constant

We need to clarify the annual contributions assumed above. Contributions to the RRSP will be higher than to the TFSA. Such is due to the tax benefit received on RRSP contributions.

For example, a taxpayer earning $100,000 per year can contribute $7,531 to their RRSP and receive a tax benefit of $2,531 for a net out-of-pocket cost of $5,000. Therefore, the model would utilize an annual investment of $7,531 in the RRSP and $5,000 in the TFSA.

We thought it prudent to generate two separate comparative models.

The first model assumes the individual’s only source of income at retirement is the RRSP or TFSA.

The second model assumes the individual receives an annual income of $20,000 from other sources (e.g., CPP and OAS) in addition to the RRSP or TFSA income. This additional income will effectively be taxed at the RRSP holders top marginal rate; whereas, such income will be the TFSA holders only taxable income and be taxed at a lower marginal tax rate.

RRSP vs. TFSA Comparison – No Other Income

First, let’s look at the power of compounding your investment returns when combined with the tax-deferral aspects of the RRSP.

The above chart illustrates that it is very possible to become a millionaire at retirement by saving $5,000 per year in an RRSP at a 6% annual return. Such does not even consider other assets (e.g., house, non-registered savings account, collectibles) that could help you well surpass the $1,000,000 threshold.

Naturally, as described earlier in this post, the RRSP balance is higher than the TFSA balance due to the ability to contribute more to an RRSP annually for the same after-tax dollars.

Our post The Power of Time and Compound Interest provides further information on the relationship between savings, interest rates, and time.

Warning

The above chart can be misleading if it is not fully understood as it shows estimated portfolios within an RRSP and TFSA. The RRSP balances are tax-deferred and will be taxed upon withdrawal. The TFSA balances are tax-free and will not be taxed upon withdrawal.

Remember, the whole point of this post is to understand and compare the tax implications of an RRSP vs. TFSA.

So, let’s get to it!

The following chart assumes the only income sources available in retirement are the RRSP and TFSA portfolios. All the data points illustrated represent annual after-tax income.

This chart illustrates that the TFSA provides a slightly better annual after-tax income than the RRSP when earning below approximately $60,000 per year. The RRSP provides superior after-tax income at approximately $60,000 per year and above.

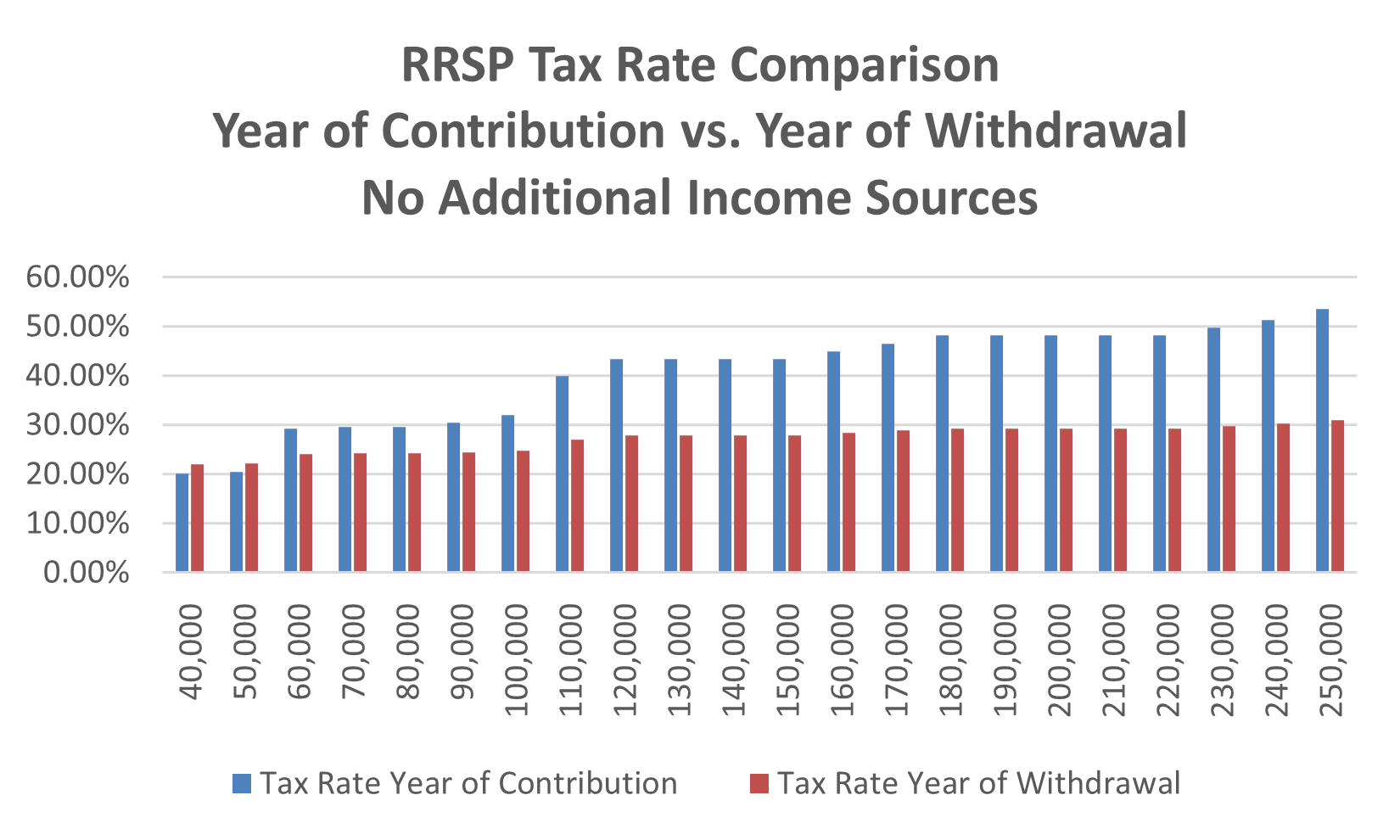

The following chart focuses on an RRSP investor and illustrates the blended tax rate experienced at the time of contribution vs. the time of withdrawal. We did not prepare a similar chart for a TFSA investor because TFSAs are tax-free, and this model assumes no other sources of taxable income.

The tax rate in the year of contribution is higher than in the year of withdrawal for incomes from approximately $60,000 and above. Such is the ideal situation and demonstrates a fundamental benefit from investing in an RRSP.

It may be surprising to see the tax rate in the year of withdrawal higher than the year of contribution for incomes below $60,000. Such is because the portfolio at age 65 was sufficient in size to create an annuity that generates more annual income in retirement than the individual was earning during their contributing years.

RRSP vs. TFSA Comparison – Plus Other Income

The above model assumed the individual did not have any other income outside of the RRSP or TFSA during retirement. Such is an unlikely scenario as all Canadians should be eligible for a minimum level of government assistance.

Therefore, the following model assumes an individual has $20,000 of other income during retirement plus the same RRSP or TFSA portfolio as illustrated in the previous model.

This chart illustrates that the TFSA provides a slightly better or comparable annual after-tax income when compared to the RRSP when earning below approximately $100,000 per year. The RRSP provides superior after-tax income at approximately $100,000 per year and above.

You will notice the TFSA outperformed the RRSP to an income threshold of approximately $100,000 vs. approximately $60,000 in the first model. Such is because the additional $20,000 income in retirement in the second model is the only taxable income for the TFSA investor. The TFSA investor would experience a much lower marginal tax rate on this additional $20,000 of income in retirement than the RRSP investor would experience.

Dollars and Cents – Which is Better?

The following are based on an individual taxpayer and their estimated after-tax income in retirement.

If you earn approximately $60,000 or less a TFSA outperforms an RRSP.

If you earn approximately $60,000 to $100,000 the TFSA and RRSP provide similar results.

If you earn approximately $100,000 or more an RRSP outperforms a TFSA.

The model comparison above illustrates that introducing other taxable income enhances the TFSA’s performance relative to the RRSP. Such is because the other taxable income is taxed at a lower marginal tax rate for the TFSA holder compared to the RRSP holder. Therefore, adjusting the other income to levels higher than the $20,000 modelled will further increase TFSA’s performance relative to the RRSP.

Its about more than just numbers …

The numbers are critical to your decision on how to allocate your funds between an RRSP and TFSA. However, we remind you of the following factors that may have a significant influence on your decision.

RRSP Home Buyers’ Plan

RRSP Lifelong Learning Plan

RRSP income splitting via a spousal RRSP

RRSP may be linked to employer matching contributions

RRSPs can be fully taxed at very high rates in the year of death unless certain types of beneficiaries are named on the account

TFSA contribution room increases annually regardless of income

TFSA withdrawals increase your contribution room

TFSA withdrawals do not trigger claw back provisions related to government programs (e.g., CPP, OAS)

CRA has challenged taxpayers for running what they consider to be a business through their TFSA. Such is typically linked to the accounts high trading volumes that are consistent with the profile of a day-trader

TFSA may be ideal for a short-term investment horizon (e.g., saving for a car)

Bottom Line

Many websites recommend TFSAs for incomes below $50,000 and RRSPs above $50,000. Our models take a different approach. We project the savings until retirement, covert such into an annuity, include other likely sources of taxable income, and model the annual after-tax income throughout retirement.

We concluded that TFSAs are competitive, if not better, for incomes below approximately $100,000 and RRSPs above $100,000. The $100,000 breakeven estimate increases as the $20,000 of other retirement income increases.

There are many factors beyond the financial model that may sway your decision in contrast to the model. We listed 10 common factors above (e.g. Home Buyers Plan, Lifelong Learning Plan, withdrawal impact on contribution room) that you should consider when making your allocation decision.

We invite you continue your research by referencing the following external links:

RRSP - CRA - FORM T1213 Request to Reduce Tax Deductions at Source

RRSP - CRA - Home Buyers’ Plan Overview

RRSP - CRA - Home Buyers’ Plan Request to Withdraw Funds from an RRSP

RRSP – CRA - Lifelong Learning Plan Overview

RRSP - CRA - Lifelong Learning Plan - Request to Withdraw Funds from an RRSP