How to Choose a Financial Advisor - A Definitive Guide

KEY POINTS

Robo-advisors can provide advisory services at a lower price than traditional advisors and may be ideal for less complex estate planning requirements

Live financial advisors are well suited for holistic estate planning

Fiduciary relationships are the key to a successful advisory team. Your interests should always come before those of your advisor.

Our questionnaire contains forty questions designed to enhance your due diligence of prospective advisors

Guide to Choosing a Financial Advisor

We invite you to download our free financial advisor due diligence questionnaire here:

Enjoy the rest of this post as it will guide you through the process. For example,

Is a robo-advisor right for you?

Or, do you require a more personal approach?

Do you need more than one advisor?

How do conflicts of interest impact the relationship?

What is a financial advisor?

We consider a financial advisor anyone employed that provides financial services, guidance, or advice to clients. The individual’s qualifications and licensing will vary based on the specific services provided.

Types of financial advisors

The financial services industry is comprised of several types of advisors. This allows you to tailor your advisory team to meet your specific short-term and long-term goals. Such goals may include buying a house or vacation property, funding university, weddings, starting a new business, or retirement.

As the complexity increases you will need professional advisors acting in a fiduciary capacity that can provide integrated, unbiased, and valuable advice pertaining to a variety of competencies including investments, life insurance, taxation, philanthropy, asset protection, foreign exchange and overall estate planning.

The following summarizes the common types of financial advisors:

|

Investment Advisor |

Trustee |

Broker |

|

Investment Manager |

Estate Planner |

Accountant / Tax Advisor |

|

Asset Manager |

Financial Planner |

Lawyer |

|

Portfolio Manager |

Personal Banker |

Insurance Agent |

We invite you to read our post Financial Advisors for the 99% to learn about each of these advisory roles.

Do you need a financial advisor?

We recommend obtaining appropriate guidance whenever you are making financial decisions. This is a prudent approach that will cost money in the short-term but will provide long-term benefits.

Even financial savvy individuals can find it difficult to develop a long-term strategic plan, understand investment risk, create a diversified portfolio, forecast cash flows and inflation rates, mitigate taxes, protect your assets, implement a reporting framework, and update the integrated plan on a regular basis.

Simple mistakes or missed planning opportunities can lead to inadvertently taking on riskier than expected investments, unintended tax consequences, expose your assets to third parties, estate transfer issues, and much more.

You may be knowledgeable regarding the traditional types of financial advisors. However, you may be unfamiliar with robo-advisors.

What is a robo-advisor?

Great question

We recommended obtaining appropriate guidance in the above section. Such guidance does not always need to come from a human advisor. The rise of robo-advisors has disrupted the industry and provided investors options that did not exist a generation ago.

This change has coincided with a shift in investor attitudes: especially younger investors. Investors are inclined to manage their own finances as they have a wealth of financial information and research at their fingertips.

They are demanding equal treatment with the world’s wealthiest families. This shifting perspective transcends their approach to financial planning. They want advice delivered on their terms, and access to the same asset classes, research, and low fee structures as afforded the top 1%.

A robo-advisor is an attractive option for investors that are just starting their journey toward building an enduring financial legacy.

So, what is a robo-advisor and what financial services they can provide?

Robo-advisors are digital services that rely on complex algorithms and are designed to provide financial advice and relevant research at a low-cost. The algorithms will assess your risk tolerance, factor in your target return, and automatically construct your portfolio for short-term or long-term objectives. Such services may also include varying degrees of retirement planning capabilities.

The robo-advisor market is competitive with individual firms offering different access to multiple asset classes. The diversity of security type can be robust and include stocks, bonds, exchange traded funds, futures, commodities, and real estate. Although robust, such may not be optimal as a live advisor may provide access to a more diverse selection of asset classes and related underlying securities.

Fees vary by firm and often range from 0.25-0.50%. This would equate to $250-$500 per year based on a $100,000 portfolio. Such range is lower than that typically charged by a live advisor.

Robo-advisor firms may also include options to engage live advisors for an additional fee. This additional service offering could prove critically important as your wealth increases and your estate planning requirements become increasingly complex. The fee range may for such additional services may increase your fee from 0.25-0.50% to 0.50-0.90%.

Should you engage a robo-advisor?

Robo-advisors can be a cost-effective option for investors with straightforward financial planning requirements. However, once your estate planning requirements become more complex, we recommend engaging the appropriate live advisors to ensure you have a holistic plan.

What is the first step in choosing a financial advisor?

You need to identify your key goals prior to searching for a financial advisor.

You may have a singular goal like determining how to invest a lump-sum amount of money for a short duration. In which case a robo-advisor may suffice.

Or, you could have complex estate planning goals that involve investing, taxation, insurance, and multi-generational wealth transfers. These interdependent objectives require an integrated approach.

Our post How to Set Investment Goals and Leave and Enduring Legacy provides a framework within which to set goals and ensure they are aligned.

Analogous to choosing a doctor, you need to determine if you need a general practitioner or a specialist. A sore throat would necessitate a trip to your local doctor, whereas multiple serious ailments may require a specialist and multiple integrated tests.

Once you have identified the type of advisor(s) required, you can commence the process of selecting the specific advisors to collaborate with you and your family.

Develop a list of financial advisor prospects

You should treat your financial advisory search like an executive search as these individuals will be managing important aspects of your life. You do not want to simply choose the most convenient advisor. You want to do your due diligence and find an advisor you are comfortable working with that can help you set and achieve your goals.

A good place to start is by asking family, friends, colleagues for referrals. Make sure you clearly articulate what services you require (without divulging any confidential information) and any specific requirements you may have.

Upon receiving a referral, be sure to ask why they are referring the individual and if they are being compensated for such referral. Referrals linked to a commission should raise a red flag. It may not be deal breaker, but it is not an ideal start to the process.

You can also ask for referrals from existing advisors or business relationships. For example, your accountant may be able to refer you to multiple advisors. You will still need to determine if the referral generates any form of direct or indirect compensation.

Advisors can be refereed for diverse reasons that may include investment performance, fee rate, types of fees charged, access to desired asset classes, technological platform, access to research, advisor personality, family relation, long-term family advisor, or for taking a proactive approach.

This leads us to consider the key traits we should look for when choosing and advisor.

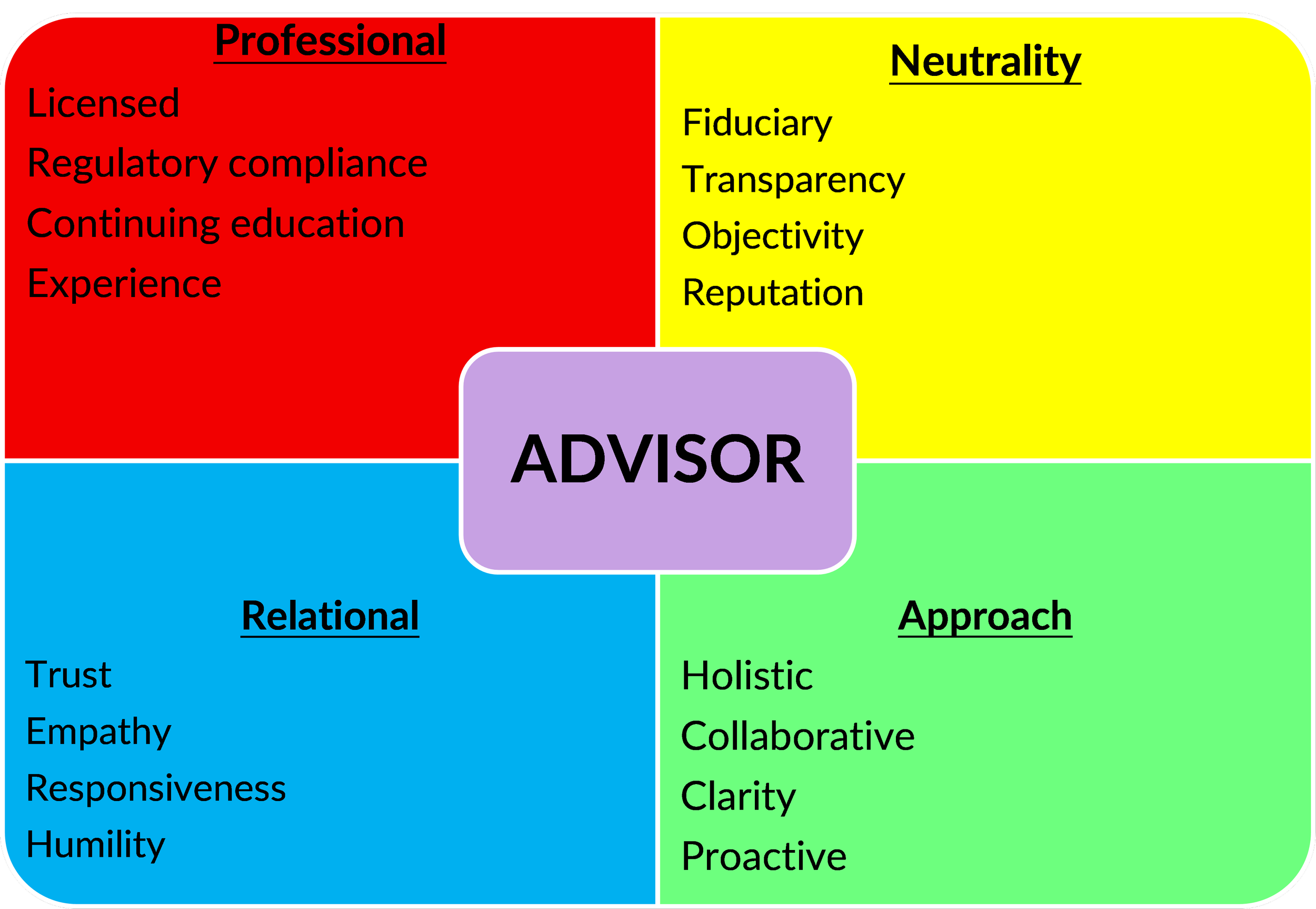

Traits of a Financial Advisor

We have categorized the key traits below in our proprietary matrix. You will undoubtedly value certain traits more than others. The key is gaining the ability to use this framework as a reference point when comparing advisors against one another.

Professional Traits

It is imperative that you verify your advisors are properly licensed and that their memberships are in good standing. Many of the governing bodies will provide an on-line option for you to quickly check an advisor’s standing. For example, you can check an advisor’s Certified Financial Planner qualifications here CFP Background Check or you can check a Chartered Financial Analyst’s qualifications here CFA Background Check.

We recommend you also reference the following during your due diligence process.

U.S. Background Checks

The Financial Industry Regulatory Authority (“FINRA”) Broker Check is an excellent starting point. FINRA is a self-regulatory organization. Their Broker Check service allows you to check on the advisor and their respective organization.

The Securities Exchange Commission (“SEC”) Action Lookup allows you to look up information about individuals who have been named in SEC federal court actions or respondents in SEC administrative proceedings.

The Investment Adviser Public Disclosure website allows you to search an investment firm and an individual investment advisor. The website will also check FINRA’s Broker Check.

Canadian Background Checks

The Canadian Securities Adminstrators' National Registration Search allows you to check the advisor or firm’s registration and what type of registration is held.

The New Self-Regulatory Organization of Canada (formerly Investment Industry Regulatory Organization of Canada) (“SROC”) allows you to check disciplinary enforcement proceedings and related notices and decisions related to an advisor.

On a related note, you can report advisors suspected of breaching SROC rules or trading on the Canadian marketplace contrary to SROC rules. You can make a complaint to SROC on the SROC website.

The Mutual Fund Dealers Association of Canada’s (“MFDA”) Enforcement Department allows you to check if the advisor breached the MFDA’s requirements. MFDA Enforcement.

Advisor complaints can be checked through the Better Business Bureau.

In Quebec, advisor complaints can be checked at Autorié Des Marchés Financiers.

We also emphasize continuing education. Many professional associations will require their membership to obtain a minimum number of hours of continuing education on an annual basis. Ideally, the advisor will ensure a relevant portion of such training is ethics based.

Experience can be invaluable. Such can be difficult to assess. Experience is not a simple function of years worked. It involves a variety of factors including types of clients, number of clients, nature of services provided, market conditions, changing regulatory environments, evolving technology and so much more.

You will need to ask probing questions. For example, you may ascertain the advisor was providing advice during a recession. Seize this opportunity to stress test the advisor. How did they communicate with clients during the market volatility? Did they meet with clients to reassess their financial plans? How did the recession impact their approach to risk management and asset allocation? Did they panic? Did they lose clients during the recession?

Neutrality Traits

The concept of fiduciary services is critical to you achieving your goals. A fiduciary always puts your interests ahead of their own. This sounds like a simple principle, but it can be a challenge to find a pure fiduciary. Some professions require the advisor to operate in a fiduciary manner. You must take all possible steps to ensure they fulfil such duty of care.

As described under Fee Arrangements below, advisors are compensated in several ways for the products and services they provide. They can also receive direct or indirect compensation by referring you to another advisor for specific advice.

You must be vigilant and take all reasonable precautions to ensure your advisors do not have any conflicts of interest. Such conflicts can take many forms. For example, the advisor may recommend products that pay them higher commissions than equally appropriate alternative options. Or they may give preferential trading access to other clients at your expense.

The key is transparency. The advisor must be open with their approach, compensation, relationships, etc. Such leads to objective unbiased advice.

A fiduciary that acts in a transparent manner while providing unbiased advice will develop a compelling reputation that will speak for itself through existing clients, other advisors, and the industry at large.

Approach Traits

The two most frequently asked questions we receive are:

How much money do I need to retire? and,

How much do I need to save per year to retire?

The answers to these questions are complex and require the application of multiple disciplines (e.g., investing, taxation, insurance, legal). The advisor may have all the required disciplines in-house or they may need to bring other specialists into the process.

We recommend you collaborate with advisors that take a holistic approach. Such a financial model will incorporate multiple goals with different time horizons: weddings, purchase a house, fund children’s post-secondary education, philanthropy, launch a new business, and retirement: to name a few.

Your advisors need to be proactive and strive to be ahead of the curve. A financial plan with multiple time horizons will require forecasted assumptions related to, but not limited to, inflation, interest rates, tax changes, regulatory changes, market volatility and many other factors. Your financial plan may require such assumptions to be forecasted over extended time periods reaching across generations.

The advisor must provide clarity throughout the entire process. They should be able to articulate their service offering from the onset. Such service offering should line up with the due diligence you perform. If you choose to engage them, their continual communications with you should remain clear.

At any point, you should be able to press pause and request that they explain any questions or concerns you have. It is essential that you understand the goals set and the underlying plan to achieve such goals.

Relational Traits

It is easy to dismiss relational traits and focus on performance when choosing an advisor. However, we recommend you do your due diligence in this regard.

It could prove critical.

An advisor’s ability to be responsive and empathetic to your situation is essential. You will experience volatility in your personal life and in the stock/bond market during your legacy journey. Volatility can foster fear and irrational behavior.

The ultimate goal is to find an advisor that can navigate you and your family through the turbulent times while attaining your legacy goals. This forges trust, and trust is the foundation for a long and prosperous relationship.

Goals Based Performance

As noted, we recommend you select advisors that take a holistic approach to your wealth that is driven by goal-based advice.

Holistic means more than creating an integrated plan to ensure your goals are achieved while protecting your assets. Your advisor must also consider assets that are not under their management. This may include accounts held with other advisors, private equity investments, real estate, and other similar holdings. You should be willing to disclose such as failure to do so could result in taking on disproportionate amounts of risk.

Advisors often measure their performance based on risk adjusted returns which measures risk in comparison to a risk-free asset like cash. Such performance measurement is useful, but incomplete. Your advisor will be responsible or helping your set multiple short-term and long-term goals. You need to understand how they will track performance in terms of realizing such goals.

Your overall performance will be impacted by the fees you pay to your advisory team. Such fees can be substantial and need to be fully understood from the onset of the relationship.

Fee Arrangements

The neutrality traits described above naturally includes taking a hard look at the fee arrangements offered by the various advisors. You should obtain a clear understanding of what fees are charged and how such are charged. The advisor should be able to put such terms in writing.

We described three primary fee models in our post Financial Advisors for the 99%. An advisor may employ a single model or a combination thereof.

Commission based fee models are based on paying commissions generated from the sale of a financial product (e.g., insurance policy, mutual funds, equity trades). This model can incentivize the advisor to employ excessive trading to increase commission compensation. Some products are inherently commission based.

For instance, life insurance contracts typically have a sizeable non-transparent commission built into the premiums you pay. You may not be able to avoid such commissions. However, you should be aware of similar commission-based products like life insurance-based annuities. Such products often have the same type of non-transparent commissions imbedded; however, you may be able to achieve the same objectives by employing alternative financial strategies.

The second fee model you may encounter is the fee-based model. This model is based on a set fee schedule. The fee is typically based on the assets under advisement and paid by you to the advisor. The terms of the fee arrangement should be in writing and provided at the onset of the engagement. Be sure to probe the advisor regarding this type of arrangement as some advisors will also want to charge commissions on some products (see insurance example noted above) and obtain referral fees in certain circumstances.

The fee only model is the third fee model. This model is aligned with the client’s interests as the advisor only earns fees from the services they provide and the assets under advisement. The advisor cannot accept commissions or referrals under this type of fee arrangement. This arrangement is a good step towards reducing advisor related conflicts of interest.

Where to begin?

We recommend the following steps to guide you and your family through the due diligence process:

Define your key short-term and long-term goals

Determine which types of advisory services you require

Determine if you need a personal financial advisor or if a robo-advisor would suffice

Request referrals from family, friends, colleagues. Perform other research to source potential candidates

Check each advisor’s credentials and professional standing against governing bodies and government regulatory databases

Meet each advisor and work through the Legacy Centric Financial Advisor Due Diligence Questionnaire

Make a short list of the advisors under final consideration

Have follow up meetings with each short-listed advisor to ask more questions and further develop the relationship

Select and formally engage your advisor(s)

What questions should you ask prospective advisors?

So far, we have provided a lot of background on what to look for in an advisor relationship. It is now time to plan your interaction with your prospective advisors. We appreciate the process can be daunting. To that end, we created a due diligence questionnaire.

Download a copy of the questionnaire here Due Diligence Questionnaire.

The questionnaire is broken down into 4 sections and is comprised of 40 questions. Each question has a section to rank the response on a scale of 1 to 5. There is also space beside each question to make notes.

The questionnaire should be viewed as a starting point. We recommend that you ask follow up questions that are probing in nature. You want to learn as much as possible about your advisor.

You can grade each advisor on a 200-point scale (40 questions with a maximum grade of 5 points each). Such can separate excellent advisors from those that are merely good or inferior. However, we caution against relying on the cumulative point totals when choosing between your top prospects.

You must consider the importance you place on the various questions. For example, you should probably place more weight on questions pertaining to transparency than you do to questions regarding hours of operation and availability.

Final Thoughts

The process of choosing a financial advisor is critical to achieving your short-term and long-term goals. You need to find advisors that will always put your interests first while guiding you through an ever-changing financial landscape. We trust our due diligence guide will help you find the best team of advisors for you and your family.

The due diligence guide can be combined with our posts related to choosing an executor, power of attorney, and trustee.

Reminder, just as you should review your financial plan on a regular basis, you should also review your chosen advisors on a regular basis. Make sure they are providing the advice and services you need and that they are tracking towards achievement of your goals within the expected timeframes.