Car Buying Tips - New vs. Used

KEY POINTS

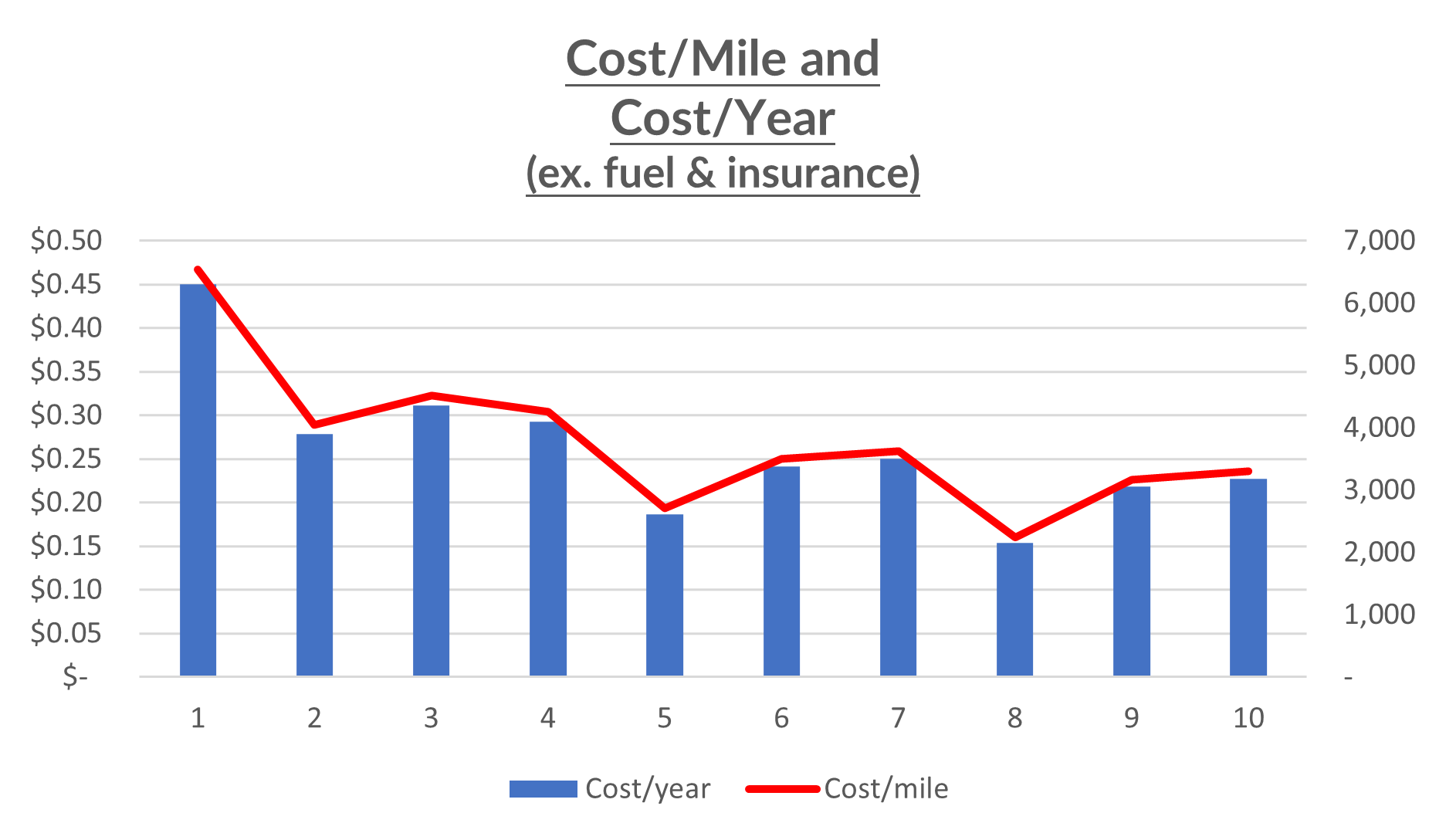

The average automobile costs $0.27/mile to maintain over its first 10 years (ex. fuel and insurance)

Automobiles are typically poor investments. Learn how quickly depreciation erodes your wealth

Our personal risk tolerances associated with expensive repairs play a major role in our decision-making process

What drives your decision?

Cost is usually the number one factor driving your purchasing decision. However, your personality and risk tolerance are also key drivers as well.

Even the most budget conscious consumer wants an automobile that reflects their personality while balancing the financial risks of costly repairs on an older vehicle.

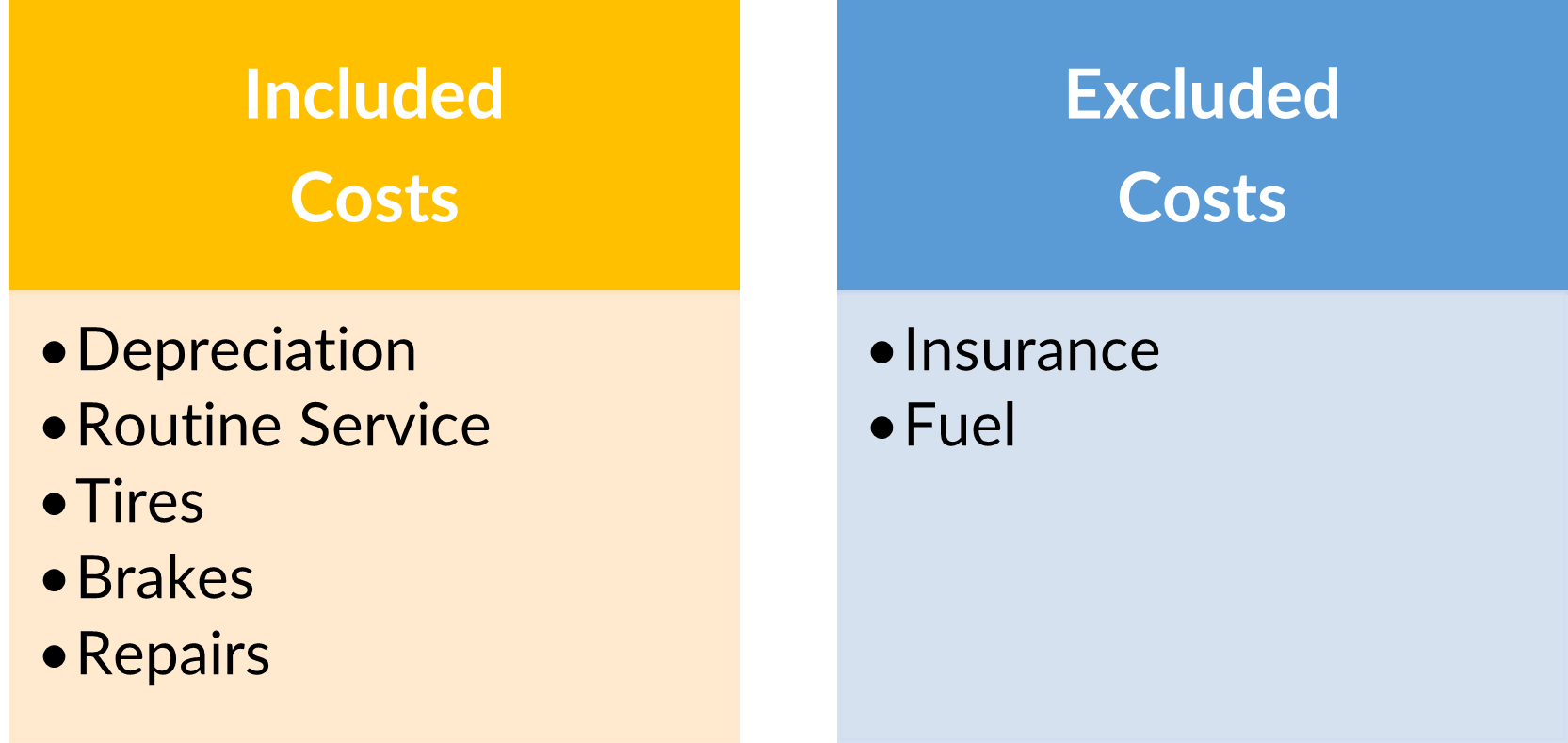

We will focus on the following costs for our analysis:

Car insurance and fuel are key financial variables that you will need to consider when choosing an automobile.

We excluded insurance as such is impacted by many variables specific to your situation including your age, driving experience, accident history, ticket history, geographic location, whether you commute to work, type of vehicle, age of vehicle, and more.

We excluded fuel as market prices are volatile and fuel economy is volatile across different types of vehicles (e.g., car, SUV, pick-up truck).

Our cost analysis is based on the average cost of vehicle over the first 10 years. Your experience may vary depending on the type of vehicle you purchase, how you drive it, and how you maintain it.

Depreciation

Depreciation is the largest annual expense of those listed above unless you experience above average repairs. It is the difference between your automobile’s value from the day you purchased it until the day you sell it. The depreciation you experience may be influenced by the following:

You can reduce the depreciation on your automobile by taking these steps:

Research car model depreciation history

Implement a routine service schedule

Maintain your service records

Do not drive aggressively

Drive safely and reduce accident risk

Limit your mileage

Wash and wax regularly

Use winter tires as appropriate

Do not customize

Car Buying Tip – Cost

We estimate the average automobile will experience the following costs over the first ten years.

As expected, depreciation dominates throughout the first five years. In years six to ten, other maintenance costs begin to match or outweigh depreciation.

These costs are better understood when overlayed with the average cost per mile (based on 13,500 miles per year).

So, what do these charts tell us?

The raw data confirms that new cars are generally more expensive to operate than used cars. However, the data becomes more meaningful when we combine the data with your risk tolerance related to unexpected repairs.

The following chart provides a first step towards narrowing down what age of car you should consider.

Brand New Car

A brand-new car typically comes with a 3-year full bumper-to-bumper warranty and provides complete protection against unexpected major repairs. However, the charts show that this comes at a cost.

Should you buy a brand-new car every 3 years?

Our model illustrates a brand-new car costs an average of $4,853 per year (ex. fuel and insurance) at a rate of $0.36/mile over the first 3 years. Whereas, if you purchased a 2-year-old car and drove it for 3 years, the average cost is $3,691 per year at a rate of $0.27/mile.

The new car costs $1,162 more per year at an increased rate of $0.09/mile. It costs approximately 30% more to drive the brand-new car.

We purposely chose a 2-year-old car in this comparison as such car would still have one year of warranty left at the time of purchase and years 4 and 5 are at low risk of experiencing a major repair.

The purchase of a 2-year-old car makes the most sense from a purely cost perspective. However, for approximately $100/month extra you can enjoy a brand-new car that comes with a full warranty and the latest technology and safety features.

Used Cars

The following table illustrates the gradual decline in annual maintenance costs per year for the average automobile.

The difference between buying a 2-year-old car and a 7-year-old car is approximately $75 per month.

Is a newer car worth the extra $75 per month?

First things first. Can you afford an extra $75 per month? If the answer is yes, then you must realize that what you are receiving for the extra $75 per month.

The newer car will likely exhibit the following:

Newer design

Better condition

Lower mileage

Newer technology

Advanced safety features

Lower risk of repair

The lower risk of repair is very important. If your budget cannot handle an expensive emergency repair, you may want to consider buying the newest model you can afford. Such may require compromise, but such is the usual process when buying an automobile.

A word on budgeting, it is vital that you budget all of your car expenses including: upfront, ongoing, and future replacement costs. Our post How to Make a Budget That Works For You can help you find a tailored budgeting approach that aligns with you unique style while ensuring you achieve your financial goals.

Bottom Line

Automobiles are expensive. You can mitigate your cost by compromising on an older model car. However, the older the car, the higher your risk of costly repairs.

For what it’s worth, my personal approach has been to buy new (or a demo) and sell the car just before the second round or brakes and tires are due for replacement. Based on my driving habits, this usually means I hold onto my car for 5-6 years. My second choice would be to buy a used car with a bit of warranty left just in case it is a lemon.

Good luck with your car search!

Resources

Click on the following links for additional resources:

United States

U.S. Department of Transportation

National Highway Traffic Safety Administration